UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULESchedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant | ☒ | |

Filed by a party other than the Registrant | ☐ |

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 |

CHINA RECYCLING ENERGY CORPORATION

China Recycling Energy Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

Payment of Filing Fee (Check all boxes that apply): | ||

☒ | No fee required. | |

☐ |

| Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act |

CHINA RECYCLING ENERGY CORPORATION

12/

4/F, Tower A

Chang An InternationalC

Rong Cheng Yun Gu Building

No. 88 Nan Guan Zheng Jie

Keji 3rd Road, Yanta District

Xi’an City, Shaanxi Province

China 710075

China 710068NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 22, 2022 AT 10:00 A.M. BEIJING TIME

April 29, 2016

Dear Stockholder:

You are cordially invited to attend the 2016 AnnualNOTICE HEREBY IS GIVEN that a Special Meeting (the “Special Meeting”) of Stockholders of China Recycling Energy Corporation, a Nevada corporation to be held at our principal executive offices, located at 12/F, Tower A, Chang An International Building, No. 88 Nan Guan Zheng Jie, Xi’an City, Shaanxi Province, 710068 China on June 27, 2016, at 10:00 a.m. local time.

The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe the formal business to be transacted at the annual meeting. Our directors, officers, and representatives of our independent registered public accounting firm will be present to respond to appropriate questions from stockholders.

Please mark, date, sign and return your proxy card in the enclosed envelope by following the instructions on the proxy card at your earliest convenience. This will ensure that your shares will be represented and voted at the meeting, even if you do not attend. If you attend the meeting, you may revoke your proxy and personally cast your vote. Attendance at the meeting does not of itself revoke your proxy.

Sincerely,

/s/ Guohua Ku

Guohua Ku

Chief Executive Officer and

Chairman of the Board of Directors

CHINA RECYCLING ENERGY CORPORATION

12/F, Tower A

Chang An International Building

No. 88 Nan Guan Zheng Jie

Xi’an City, Shaanxi Province

China 710068

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 27, 2016

NOTICE HEREBY IS GIVEN that the 2016 Annual Meeting of Stockholders of China Recycling Energy Corporation, a Nevada corporation,(the “Company”), will be held at our principal executive offices, located at 12/4/F, Tower A, Chang An InternationalC, Rong Cheng Yun Gu Building, No. 88 Nan Guan Zheng Jie,Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, 710068710075 China on June 27, 2016,February 22, 2022, at 10:00 a.m. local time, to consider and act upon the following:

Information relating2. to transact any other business as may properly come before the above matters is set forth inmeeting or at any adjournment thereof.

Our Board of Directors unanimously recommends a vote FOR the attached Proxy Statement. StockholdersName Change (Item 1) described above.

Our Board of Directors has fixed the close of business on January 12, 2022, as the record date (the “Record Date”) for the determination of shareholders entitled to notice of, and to vote at, the Special Meeting. Only our shareholders of record at the close of business on April 28, 2016 arethe Record Date will be entitled to receive notice of, and to vote at, the 2016 AnnualSpecial Meeting andor any adjournments or postponements thereof. The proxy statement and accompanying proxy card will first be sent to shareholders beginning on or around February 1, 2022.

By OrderFor entry to the Special Meeting, each shareholder may be asked to present valid picture identification, such as a driver’s license. Shareholders holding stock in brokerage accounts (“street name” holders) will need to bring a copy of a brokerage statement reflecting stock ownership as of the Board of Directors.Record Date. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

/s/ Guohua Ku

Chief Executive Officer and ChairmanFor ten days before the Special Meeting, a complete list of the Board of Directors

shareholders entitled to vote at the meeting will be available for examination by any shareholder for any purpose relating to the meeting during ordinary business hours at the Company’s executive officers at 4/F, Tower C, Rong Cheng Yun Gu Building, Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, China710075 China.

By Order of the Board of Directors | ||

/s/ Guohua Ku | ||

Guohua Ku Chief Executive Officer and Chairman of the Board of Directors | ||

Xi’an City, Shaanxi Province, China | ||

February 2, 2022 |

April 29, 2016

Important Notice RegardingIt is important that your shares are represented at the Availability of Proxy Materials forSpecial Meeting. We urge you to review the

Annual Meeting of Stockholders to be held on June 27, 2016:

Whether attached proxy statement and, whether or not you plan to attend OUR 2016 Annualthe Special Meeting of STOCKHOLDERS,in person, please vote your shares promptly by either completing, signing and returning the accompanying proxy card or casting your vote is important.via facsimile, the Internet or by telephone as directed on the proxy card. You do not need to affix postage to the enclosed reply envelope if you mail it within the United States. If you attend the Special Meeting, you may withdraw your proxy and vote your shares personally.PLEASE READ THE ATTACHED PROXY STATEMENT AND PROMPTLY COMPLETE, EXECUTE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING POSTAGE–PAID ENVELOPE BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. IF YOU ATTEND OUR 2016 ANNUAL MEETING of STOCKHOLDERS, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU SO DESIRE.

CHINA RECYCLING ENERGY CORPORATION

12/

4/F, Tower A

Chang An InternationalC

Rong Cheng Yun Gu Building

No. 88 Nan Guan Zheng Jie

Keji 3rd Road, Yanta District

Xi’an City, Shaanxi Province

China 710075

China 710068

PROXY STATEMENT

FOR THE ANNUALSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 22, 2022 AT 10:00 A.M. BEIJING TIME

To Be Held June 27, 2016

The Special Meeting

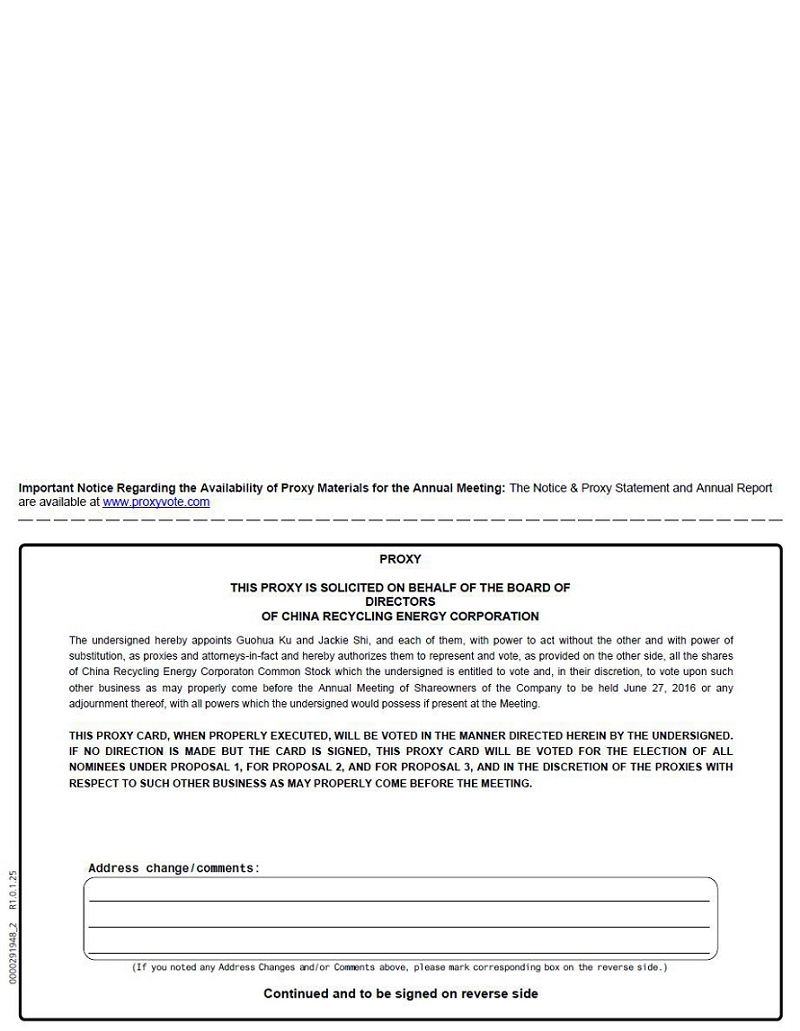

We are furnishing this Proxy Statement to the stockholders of China Recycling Energy Corporation, a Nevada corporation (the “Company”), in connection with the solicitation of proxies, by the Company’s Board of Directors of China Recycling Energy Corporation (the “Board”),of proxies to be voted for use at our 2016 Annualthe Special Meeting of Stockholders to be held at our principal executive offices, located at 12/4/F, Tower A, Chang An InternationalC, Rong Cheng Yun Gu Building, No. 88 Nan Guan Zheng Jie,Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, 710068710075 China, on June 27, 2016,February 22, 2022, at 10:00 a.m. local time, for the purpose of considering and voting:

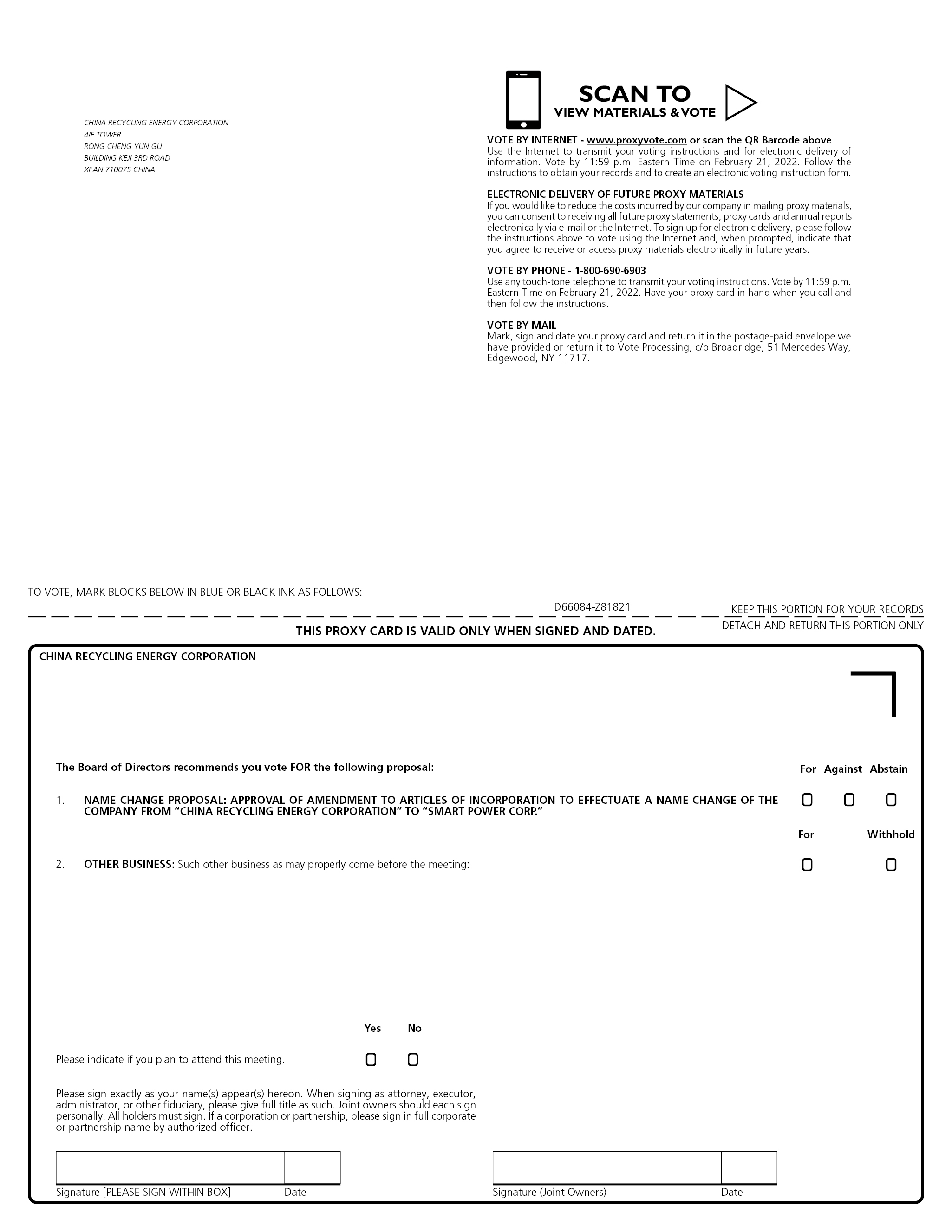

1. to approve a proposal to amend the Articles of Incorporation (the “Articles of Incorporation”) of the Company to change the name of the Company from “China Recycling Energy Corporation” to “Smart Power Corp.” (the “Name Change”); and

2. to transact any other business as may properly come before the meeting or at any adjournmentsadjournment thereof.

It is important that you vote your shares whether or postponements ofnot you attend the meeting.meeting in person. If you attend the Special Meeting, you may vote in person even if you have previously returned your proxy card or voted on the Internet or by telephone as directed on the proxy card. Shares represented by proxy will be voted in accordance with the instructions you provide on the proxy. If you submit a proxy with no instructions, the shares will be voted “FOR” the proposals presented and discussed in this proxy statement. All validly executed proxies received by our Board pursuant to this solicitation will be voted at the Special Meeting, and the directions contained in such proxies will be followed.

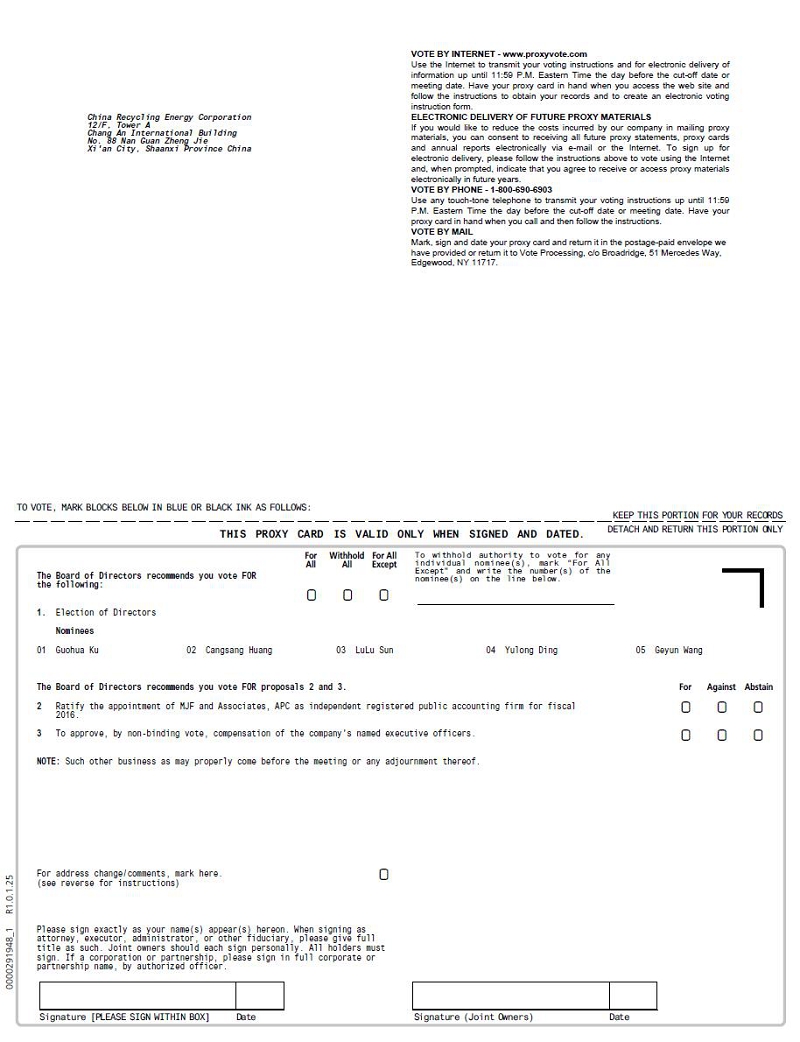

The proxy card is attached as Appendix A to this proxy statement.

When used in this Proxy Statement, the terms “we,” “us,” “our,” the “Company” and “CREG” refer to China Recycling Energy Corporation, a Nevada corporation, and its wholly-owned subsidiary, Sifang Holdingswholly-owned subsidiaries, Shanghai Yinghua Financial Leasing Co., Ltd., (“Yinghua”) and Sifang Holdings Co., Ltd.’s wholly-owned (“Sifang”), and Sifang’s wholly-owned subsidiaries, Huahong New Energy Technology Co., Ltd. (“Huahong”) and Shanghai TCH, Energy Technology Co., Ltd. and Shanghai TCH Energy Technology Co., Ltd’s wholly-owned subsidiary,TCH’s wholly-owned subsidiaries, Xi’an TCH Energy Technology Co.Company, Ltd. (“Xi’an TCH”), Ltd., and Xi’an TCH’s wholly-ownedwholly-owned subsidiary Erdos TCH Energy Saving Development Co., Ltd. (“Erdos TCH”), Zhong Xun and Zhongxun Energy Investment (Beijing) Co., Ltd.Ltd (“Zong xun”Zhongxun”) and Xi’an TCH’s 90% and Shanghai TCH’s 10% owned subsidiary Xi’an Zhonghong New Energy Technology Co., Ltd. “China” and the “PRC” refer to the People’s Republic of China, excluding, for the purposes of this Proxy Statement, Hong Kong, Macau and Taiwan.

The date on which we are first sending this Proxy Statement and form of proxy card to our stockholders is on or about May 4, 2016.

February 2, 2021.

This Proxy Statement, our Annual Report on Form 10-K,10-K for the fiscal year ended December 31, 2015,2020, and other proxy materials, including the Proxy Card and the Notice of AnnualSpecial Meeting, are available online at http://www.sec.gov/edgar.shtml.edgar.shtml. Directions to our 2016 Annualthe Special Meeting of Stockholders are available by calling +86-29-8769-1097.

ABOUT THE+862016 Annual Meeting-29-8769-1097

General: Date, Time and Place

We are providing this Proxy Statement to you in connection with the solicitation, on behalf of our Board, of proxies to be voted at our 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) or any postponement or adjournment of that meeting. The 2016 Annual Meeting will held on June 27, 2016, at 10:00 a.m. local time at our principal executive offices, located at 12/F, Tower A, Chang An International Building, No. 88 Nan Guan Zheng Jie, Xi’an City, Shaanxi Province, 710068 China.

Matters to be Considered and Voted Upon

At the 2016 Annual Meeting, stockholders will be asked to consider and vote (i) to elect the nominees named herein as directors, (ii) to ratify the selection of our independent registered public accounting firm, and (iii) to conduct an advisory vote on the compensation of our named executive officers. The Board does not know of any matters to be brought before the meeting other than as set forth in the notice of meeting. If any other matters properly come before the meeting, the persons named in the enclosed form of proxy or their substitutes will vote in accordance with their best judgment on such matters.

.

1

Record Date; Stock Outstanding andShares Entitled to Vote

Our Board has established April 28, 2016fixed the close of business on January 12, 2022, the Record Date, as the record date. Only holdersdate for the determination of shares of the Company’s common stock, par value $.001 per share (“Common Stock”), as of the record date areshareholders entitled to notice of, and to vote at, the 2016 AnnualSpecial Meeting. On the Record Date, 7,102,666 shares of our common stock, par value $0.001 per share (the “Common Stock”), were issued and outstanding. Each outstanding share of common stock entitles the holder thereofCommon Stock is entitled to one vote per share on each matter presentedproposal submitted to our stockholders for approvalvote at the 2016 AnnualSpecial Meeting. At the close of business on April 25, 2016, we had 83,084,035 shares of common stock outstanding. We expect the same number of shares to be outstanding as of the record date.

Quorum; Required Vote

A quorum of stockholders is required for the transaction of business at the 2016 AnnualSpecial Meeting. The presence of at least one-thirdone-third of all of our shares of common stockCommon Stock issued and outstanding and entitled to vote at the meeting, present in person or represented by proxy, will constitute a quorum at the meeting. Votes cast by proxy or in person at the 2016 AnnualSpecial Meeting will be tabulated by an election inspector appointed for the meeting and will be taken into account in determining whether or not a quorum is present. Abstentions and broker non-votes,non-votes, which occur when a broker has not received customer instructions and indicates that it does not have the discretionary authority to vote on a particular matter on the proxy card, will be included in determining the presence of a quorum at the 2016 AnnualSpecial Meeting.

Assuming that a quorum is present, our stockholders may take action at the annualspecial meeting with the votes described below.

ElectionAmendment to our Articles of Directors. Under Nevada law and the Fourth Amended and Restated Bylaws of the Company (“Bylaws”), the affirmative vote of a plurality of the votes cast by the holders of our shares of common stock is required to elect each director. Consequently, only shares that are voted in favor of a particular nominee will be counted toward such nominee’s achievement of a plurality. Stockholders do not have any rights to cumulate their votes in the election of directors. Abstentions and broker non-votes will not be counted toward a nominee’s total.

Ratification of the selection of MJF and Associates, APC as our independent registered public accounting firm. Incorporation. The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to voteactually voted on the proposal at the annual meetingSpecial Meeting, provided a quorum is present, is required to ratifyapprove the selectionproposed amendment to our Articles of MJF and Associates, APC as our independent registered public accounting firm.Incorporation. Abstentions and broker non-votesnon-votes will have the effect of a vote “against” the ratificationamendment to our Articles of the appointment of MJF and Associates, APC as our independent registered public accounting firm.Incorporation.

Non-binding advisory vote regarding the compensation of our named executive officers. The affirmative vote of the holders of a majority of the outstanding shares of our common stock entitled to vote at the annual meeting is required to approve the compensation of our named executive officers. Abstentions and broker non-votes will not be counted as votes approving the compensation of our named executive officers.

Abstentions and Broker Non-Votes

Under applicable regulations, if a broker holds shares on your behalf, and you do not instruct your broker how to vote those shares on a matter considered “routine,” the broker may generally vote your shares for you. A “broker non-vote”non-vote” occurs when a broker has not received voting instructions from you on a “non-routine”“non-routine” matter, in which case the broker does not have authority to vote your shares with respect to such matter. Rules that govern how brokers vote your shares have recently changed. Unless you provide voting instructions to a broker holding shares on your behalf, your broker may no longernot use discretionary authority to vote your shares on any of the matters to be considered at the 2016 AnnualSpecial Meeting other than the ratification of our independent registered public accounting firm. Please vote your proxy so your vote can be counted.

Proxy Solicitation

Voting Procedure; VotingThis solicitation of Proxies; Revocation of Proxies

If your shares are registered directly in your name withproxies is being made by our transfer agent, Securities Transfer Corporation, you are considered the “stockholder of record” with respect to those shares. As the stockholder of record, you may vote in person at the 2016 Annual Meeting or vote by proxy using the accompanying proxy card. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the 2016 Annual Meeting and vote in person even if you have already voted by proxy.

By Internet – stockholders may vote on the internet by logging on to www.proxyvote.com and following the instructions given.

By Telephone – stockholders may vote by calling 1-800-690-6903 (toll-free) with a touch tone telephone and following the recorded instructions.

By Mail – stockholders must request a paper copy of the proxy materials to receive a proxy card and follow the instructions given for mailing. A paper copy of the proxy materials may be obtained by logging onto www.proxyvote.com and following the instructions given. To vote using the proxy card, simply print the proxy card, complete, sign and date it and return it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. In the alternative, the proxy card can be mailed directly to the Company: Mr. Jackie Shi, Chief Financial Officer, at 12/F, Tower A, Chang An International Building, No. 88 Nan Guan Zheng Jie, Xi’an City, Shaanxi Province, 710068 China.

If you vote by telephone or via the Internet, you do not need to return your proxy card. Telephone and Internet voting are available 24 hours a day and will close at 11:59 P.M. Eastern Time on Sunday, June 26, 2016.

In Person - stockholders may vote in person at the 2016 Annual Meeting. To vote in person, come to the 2016 Annual MeetingBoard, and we will give you a ballot when you arrive. The Board recommends that you vote using one of the other voting methods, since it is not practical for most stockholders to attend the 2016 Annual Meeting.

Please note that the notice letter you received directing you to the website at which the proxy materials are available is not the proxy card and should not be used to submit your vote.

If you do not return a signed proxy card and do not attend the meeting and vote in person, your shares will not be voted. Shares of our common stock represented by properly executed proxies that are received by us and are not revoked will be voted at the 2016 Annual Meeting in accordance with the instructions contained therein. If you return a signed and dated proxy card and instructions are not given, such proxies will be voted FORelection of each nominee for director named herein, FOR ratification of the selection of MJF and Associates, APC as our independent registered public accounting firm, andFOR approval of the compensation of our named executive officers described in this Proxy Statement. In addition, we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by us, in our sole discretion, on any matters brought before the 2016 Annual Meeting for which we did not receive adequate notice under the proxy rules promulgated by the Securities and Exchange Commission (“SEC”).

If you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you are considered the “beneficial owner” of such shares. Because a beneficial owner is not a stockholder of record, you may not vote these shares in person at the 2016 Annual Meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote those shares at the meeting. If you wish to attend the 2016 Annual Meeting and vote in person, you will need to contact your broker, bank or nominee to obtain a legal proxy.

Your proxy is revocable at any time before it is voted at the 2016 Annual Meeting in any of the following three ways:

1. You may submit another properly completed proxy bearing a later date.

2. You may send a written notice that you are revoking your proxy to Mr. Jackie Shi, our Chief Financial Officer, at 12/F, Tower A, Chang An International Building, No. 88 Nan Guan Zheng Jie, Xi’an City, Shaanxi Province, 710068 China.

3. You may attend the annual meeting and vote in person. However, simply attending the annual meeting will not, by itself, revoke your proxy.

Dissenters’ Right of Appraisal

Stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the 2016 Annual Meeting.

Proxy Solicitation

We will pay for the entire cost of soliciting proxies.preparing and distributing these proxy materials. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Voting Procedure; Voting of Proxies; Revocation of Proxies

HouseholdingIf your shares are registered directly in your name with our transfer agent, Securities Transfer Corporation, you are considered the “stockholder of record” with respect to those shares. As the stockholder of record, you may vote in person at the Special Meeting or vote by proxy using the accompanying proxy card. Whether or not you plan to attend the special meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting and vote in person even if you have already voted by proxy.

By Internet — stockholders may vote on the internet by logging on to www.proxyvote.com and following the instructions given.

SEC rules permit us to deliverBy Telephone — stockholders may vote by calling 1-800-690-6903 (toll-free) with a single proxy statementtouch tone telephone and annual report to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one proxy statement and annual report to multiplefollowing the recorded instructions.

2

By Mail — stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oralmust request a separatepaper copy of this Proxy Statement and annual report to any stockholder at the shared address to which a single copy of those documents were delivered. If you prefer to receive separate copies of the proxy statementmaterials to receive a proxy card and annual report, contact Mr. Jackie Shi, our Chief Financial Officer,follow the instructions given for mailing. A paper copy of the proxy materials may be obtained by logging onto www.proxyvote.com and following the instructions given. To vote using the proxy card, simply print the proxy card, complete, sign and date it and return it promptly to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. In the alternative, the proxy card can be mailed directly to the Company: Ms. Adeline Gu, Secretary, at 12/4/F, Tower A, Chang An InternationalC, Rong Cheng Yun Gu Building, No. 88 Nan Guan Zheng Jie,Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, 710068710075 China.

If you vote by telephone or via the Internet, you do not need to return your proxy card. Telephone and Internet voting are available 24 hours a day and will close at 11:59 P.M. China Time on February 21, 2022.

In Person — stockholders may vote in person at the Special Meeting. To vote in person, come to the Special Meeting and we will give you a ballot when you arrive. The Board recommends that you vote using one of the other voting methods, since it is not practical for most stockholders to attend the Special Meeting.

Please note that the notice letter you received directing you to the website at which the proxy materials are available is not the proxy card and should not be used to submit your vote.

If you do not return a signed proxy card and do not attend the meeting and vote in person, your shares will not be voted. Shares of our common stock represented by properly executed proxies that are received by us and are not revoked will be voted at the Special Meeting in accordance with the instructions contained therein. If you return a signed and dated proxy card and instructions are not given, such proxies will be voted FOR the change of Company name. In addition, we reserve the right to exercise discretionary authority to vote proxies, in the manner determined by us, in our sole discretion, on any matters brought before the Special Meeting for which we did not receive adequate notice under the proxy rules promulgated by the Securities and Exchange Commission (“SEC”).

If you hold your shares in “street name” through a stockbroker, bank or other nominee rather than directly in your own name, you are considered the “beneficial owner” of such shares. Because a beneficial owner is not a stockholder of record, you may not vote these shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote those shares at the meeting. If you wish to attend the Special Meeting and vote in person, you will need to contact your broker, bank or nominee to obtain a legal proxy.

Your proxy is revocable at any time before it is voted at the Special Meeting in any of the following three ways:

1. You may submit another properly completed proxy bearing a later date.

2. You may send a written notice that you are revoking your proxy to Ms. Adeline Gu, our Secretary, at 4/F, Tower C, Rong Cheng Yun Gu Building, Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, 710075 China.

3. You may attend the special meeting and vote in person. However, simply attending the special meeting will not, by itself, revoke your proxy.

Dissenters’ Right of Appraisal

Stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the Special Meeting.

Stockholder List

For at least ten days prior to the meeting, a list of stockholders entitled to vote at the 2016 AnnualSpecial Meeting, arranged in alphabetical order, showing the address of and number of shares registered in the name of each stockholder, will be open for examination by any stockholder, for any purpose related to the 2016 AnnualSpecial Meeting, during ordinary business hours at our principal executive offices. The list will also be available for examination at the 2016 AnnualSpecial Meeting.

3

Other Business

The Board is not aware of any other matters to be presented at the 2016 AnnualSpecial Meeting other than those mentioned in this Proxy Statement and our accompanying Notice of AnnualSpecial Meeting of Stockholders. If, however, any other matters properly come before the 2016 AnnualSpecial Meeting, the persons named in the accompanying proxy will vote in accordance with their best judgment.

Proposals of Stockholders for 2017 Annual Meeting

Stockholder proposals will be considered for inclusion in the proxy statement for the 2017 Annual Meeting in accordance with Rule 14a-8 under Securities Exchange Act of 1934, as amended (the “Exchange Act”), if they are received by the Company, on or before January 4, 2017.

Stockholder notice shall set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and address, as they appear on our books, of the stockholder proposing such business, (iii) the class and number of shares of CREG, which are beneficially owned by the stockholder, (iv) any material interest of the stockholder in such business and (v) any other information that is required to be provided by the stockholder pursuant to Regulation 14A under the Exchange Act, in his capacity as a proponent to a stockholder proposal.

A stockholder’s notice relating to nomination for directors shall set forth as to each person, if any, whom the stockholder proposes to nominate for election or re-election as a director: (i) the name, age, business address and residence address of such person, (ii) the principal occupation or employment of such person, (iii) the class and number of shares of CREG, which are beneficially owned by such person, (iv) a description of all arrangements or understandings between the stockholder and each nominee and any other person(s) (naming such person(s)) pursuant to which the nominations are to be made by the stockholder and (v) any other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including without limitation such person’s written consent to being named in our Proxy Statement, if any, as a nominee and to serving as a director if elected).

Proposals and notices of intention to present proposals at the 2017 Annual Meeting should be addressed to our Mr. Jackie Shi, our Chief Financial Officer, at our principal executive offices, located at 12/F, Tower A, Chang An International Building, No. 88 Nan Guan Zheng Jie, Xi’an City, Shaanxi Province, 710068 China.

A copy of the full text of the provisions of our Bylaws, as amended, dealing with stockholder proposals is available to stockholders from our Secretary upon written request and an electronic copy of is available at the SEC’s website located at www.sec.gov.

Voting Results of 2016 Annualthe Special Meeting

Voting results will be published in a Current Report on Form 8-K8-K issued by us within four (4) business days following the annual meeting.Special Meeting.

4

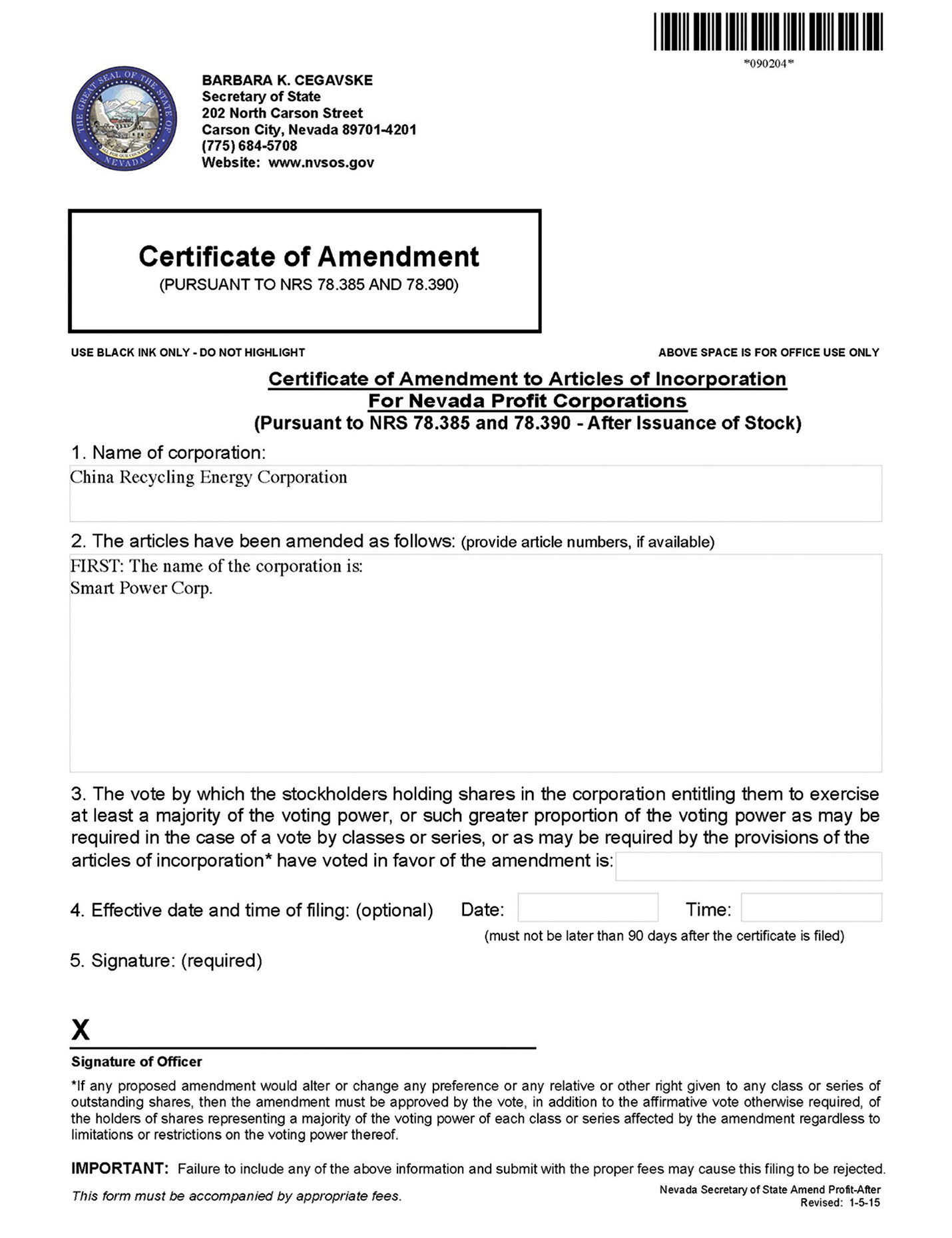

AMENDMENT TO ARTICLES OF INCORPORATION OF THE COMPANY

TO CHANGE THE NAME OF THE COMPANY FROM CHINA RECYCLING ENERGY

CORPORATION TO SMART POWER CORP.

(Name Change Proposal on Proxy)

PROPOSAL 1— ELECTION OF DIRECTORS

Nominees

Our Bylaws provide that the Board shall consist of not less than three (3) nor more than eleven (11) directors. OurThe Board has fixedunanimously adopted and now recommends for your approval a proposal to amend our Articles of Incorporation to change the number of directors to be elected at the 2016 Annual Meeting at five (5). Vacancies on the Board may be filled only by persons elected by a majorityname of the remaining directors. A director elected by the BoardCompany from China Recycling Energy Corporation to fill a vacancy (including a vacancy created by an increase in the Board of Directors) will serve for the remainderSmart Power Corp. The text of the one year term in which the vacancy occurred and until the director’s successor is elected and qualified.

Our Board currently consistsproposed amendment to our Articles of five (5) members. Our current directors will stand for re-election at the 2016 Annual Meeting. Four of the nominees were previously elected by our stockholders at the 2015 Annual Meeting.One nominee, Ms. LuLu Sun will stand for election for the first time.

If elected as a director at the 2016 Annual Meeting, each of the nominees would serve a one-year term expiring at the 2017 Annual Meeting of Stockholders and until his successor has been duly elected and qualified. Biographical information regarding each of the nomineesIncorporation is set forth below. No family relationships exist among anyin Appendix B to this proxy statement.

We believe the current name of our director nominees or executive officers.

Each ofChina Recycling Energy Corporation no longer accurately reflects the nominees has consented to serve as a director if elected. If any nominee should be unavailable to serve for any reason (which is not anticipated), the Board may designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxy cards for the election of such substitute nominee or nominees), allow the vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors.

Executive Officers and Directors

The following table sets forth certain information regarding our executive officers and director nominees as of April 25, 2016:

Mr. Guohua Ku was appointed as a director and Chief Executive Officer as of December 10, 2008. He was elected Chairman of the Board as of April 1, 2009. Prior to joining the Company, Mr. Ku served as a Senior Engineer for Yingfeng Technology from 2003 to 2007. From 1979 to 2003, Mr. Ku served in multiple capacities for Shaanxi Blast Air Blower (Group) Co., Ltd., with his last position serving as a Senior Engineer. Mr. Ku’s experience as our Chief Executive Officer, as well as Chairman of the Board, and extensive scientific and operational knowledge and expertise qualifies him to serve as Chairman of the Board and led the Board to conclude that he should be nominated to serve another term as a director.

Mr. Jackie Shi was appointed as the Chief Financial Officer and Secretaryoperations of the Company, and we believe the proposed name change will better serve the Company’s current business focus. We are currently in May 2015. He studied professional accounting in Universitythe process of New South Wales, Australia from 2001 to 2003,transforming and was awarded his master degree of finance in 2003. He studied public administration at Northwest University of China from 1994 to 1998, and obtained his bachelor degree of law in 1998. Mr. Shi joined Xi’an TCH in 2014 as a VP of Finance and he previously worked as the Director of Investor Relations for Xilan Natural Gas Group from 2005 to 2014. Before that, Mr. Shi worked as the Deputy Financial Manager for a four-star hotel in Sydney, Australia from 2003 to 2004, and worked asexpanding into an assistant to CEO in Shaanxi Qinjing Industrial and Commercial Company from 1998 to 2000.

Mr. Yulong Ding was elected as a director at the 2014 Annual Meeting, and currently serves in instructional and leadership roles at the University of Birmingham (England) since October 2013 where he has served as (i) Director of the Birmingham Centre for Thermal Energy Storage and Birmingham Centre for Cryogenic Energy Storage (October 2013 – present), (ii) Professor of Chemical Engineering (October 2013 – present), and (iii) Highview-Royal Academy of Engineering Professor of Cryogenic Energy Storage (March 2014 – present). Prior to his time at the University of Birmingham, Mr. Ding served as a professor and director of Particle Science & Engineering at the at the University of Leeds, and director of joint energy storage research institute between Universityintegrated solution provider. We actively seek and explore opportunities to apply energy storage technologies to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV) and wind power stations, remote islands without electricity, and cities with multi-energy supplies. Therefore, we believe that the new name is more in line with our current business strategy and operation.

The name change proposal, if approved by our shareholders, would have the effect of Leeds and Institute of Process Engineering of Chinese Academy of Sciences.

Mr. Geyun Wang was elected as a director atchanging the 2014 Annual Meeting, and healso serves as a Vice Presidentlegal name of the Company. Mr. WangIf the name change is responsible fornot approved, the procurement of engineering equipment and tendering for project construction, as well as supervision of installation and commissioning for EPC projects. Mr. Wang was the Deputy General Manager of our subsidiary Xi'an TCHCompany’s legal name will continue to be China Recycling Energy Technology Co., Ltd. between 2007 and 2015 and he was appointed as a Vice President of the Company in 2015 Prior to this position, From 2001 to 2007, Mr. Wang served as the Vice President of Sales of Shaanxi Baoji Hongguang Iron & Steel Co., Ltd., where he was responsible for sales of steel products. Mr. Wang received his bachelor degree from Northwestern Polytechnical University in 1988. Mr. Wang’s extensive project construction and management experience, as well as his extensive industry and market expertise,qualifies him to serve on our Board and led the Board to conclude that he should be nominated as a director.Corporation.

Mr. Cangsang Huang was appointed as a director on March 31, 2015 by the Board to fill the vacancy due to the resignation of Mr. Chungui Shi. Mr. Huang was also appointed as a member of the Corporate Governance and Nominating Committee, the Audit Committee and Compensation Committee of the Board. Mr. Huang has served as Chief Financial Officer of SouFun Holdings Limited (NYSE: SFUN) since January, 2016 and he was the Deputy CFO of SouFun Holdings from October 2015 to January 2016. Mr. Huang has served as Chief Financial Officer ("CFO") and Principal Accounting Officer of China Housing and Land Development, Inc. ("China Housing") from June 2009 to December 2014 and he was the assistant CFO of China Housing from October 2008 to June 2009. From 2007 to 2008, Mr. Huang worked for Collins Stewart LLC in New York City and from 2006 to 2007, Mr. Huang worked for Cantor Fitzgerald & Co. in New York City. From 2001 to 2004, Mr. Huang worked as a project manager at China Communication Construction Company Limited in Guangzhou, China. Mr. Huang received his bachelor degree in economics from Shanghai Maritime University in 2001 in Shanghai, China and his master's degree in statistics from Columbia University in 2006 in New York City. Mr. Huang's extensive experience in financing and accounting as well as with a U.S. listed Chinese company qualifies him to serve on our Board and led the Board to conclude that he should be nominated as a director.

Ms. LuLu Sun was appointed as a director on August 5, 2015 by the board to fill the vacancy due to the resignation of Mr. Albert McLelland. Ms. Sun serves as Marketing Director for Net Engine Power Tech. Ltd. Co. in China from June 2013 to present and she was the New Media Business Development Director for Rayli Magazine in China from June 2009 to May 2013. From July 2002 to May 2009, Ms. Sun was the Business Development Project Manager for Sina Mobile in China. Ms. Sun's extensive experience in marketing and business development in China qualifies her to serve on our Board and led the Board to conclude that she should be nominated as a director.

Mr. Xiaoshan He was appointed as the Vice President in March 2015. He studied securities investment and management at Southwest University of Finance and Economics (in China) from 1992 to 1996 and received his for bachelor degree in 1996. Mr. He joined our subsidiary Xi’an TCH in 2007 and was in charge of marketing and administration. He previously worked as the Manager for Yilong Service Branch, Nanchong Business Department of Hexing Securities from 2002 to 2006, worked as the Head of Asset Management Department for Nanchong Business Department of Hexing Securities from 1999 to 2002, worked as a clerk in Sales Department of Sichuan Nanchong Trust Investment Company for two years from 2003 to 2005, and worked as a future broker for Chengdu Xing Xin Futures Co., Ltd. from 2006 to 2007.

Mr. Bohan Zhang was appointed as the Vice President in charge of Accounting in March, 2015. Mr. Zhang studied accounting for tertiary education at Xi’an Technology Institute in Xi'an China from 1987 to 1990 and studied and majored in accounting from 1995 to 1998 at Northwest University of China and obtained his bachelor degree in 1998. Mr. Zhang attended the SOX404 internal control training and US GAAP training held by PWC Singapore. Mr. Zhang joined our subsidiary Xi’an TCH in 2007 as the head of its Finance and Accounting Department. Mr. Zhang previously worked as the Financial Manager for Xi’an Dapeng Biological Technology Co., Ltd. from 2000 to 2007 and worked as the Financial Manager for a wholly foreign-owned enterprise, Xi'an Tipco Food Co., Ltd. for four years from 1996-2000. Mr. Zhang workedThe change in the Finance and Accounting Department for a large state-owned enterprise, Northwest Medical Equipment Factory, from 1990 to 1995.

All directors hold office untilCompany’s name will not affect the next annual meeting of stockholders and until their successors have been duly elected and qualified.

There are no arrangements or understandings pursuant to which our directors are selected or nominated.

The Board recommends that the stockholders vote “FOR” the election of each of the director nominees named in this proxy statement.

CORPORATE GOVERNANCE

Leadership Structure and Role in Risk Oversight

The Company’s current board leadership structure separates the board chair and principal executive officer roles into two positions. Mr. Ku has served as both Chairman of the Board and CEO of the Company since April 1, 2009. Our Board continues to believe there are important advantages to Mr. Ku serving in both roles at this time. Mr. Ku is the director most familiar with our business and industry and is best situated to propose Board agendas and lead Board discussions on important matters. Mr. Ku provides a strong link between management and the Board, which promotes clear communication and enhances strategic planning and implementation of corporate strategies. Another advantage is the clarity of leadership provided by one person representing us to employees, stockholders and other stakeholders. The Board has not named a lead independent director.

Our Board is responsible for oversight of the Company’s risk management practices while management is responsible for the day-to-day risk management processes. In the Board’s opinion, this division of responsibilities is the most effective approach for addressing the risks facing the Company. The Board receives periodic reports from management regarding the most significant risks facing the Company. In addition, the Audit Committee assists the Board in its oversight of our risk assessment and risk management policies. Our Audit Committee is empowered to appoint and oversee our independent registered public accounting firm, monitor the integrity of our financial reporting processes and systems of internal controls and provide an avenue of communication among our independent auditors, management, our internal auditing department and our Board.

Diversity

The Board does not have a formal policy with respect to Board nominee diversity. In recommending proposed nominees to the full Board, the Corporate Governance and Nominating Committee is charged with building and maintaining a board that has an ideal mix of talent and experience to achieve our business objectives in the current environment. In particular, the Corporate Governance and Nominating Committee is focused on relevant subject matter expertise, depth of knowledge in key areas that are important to us, and diversity of thought, background, perspective and experience so as to facilitate robust debate and broad thinking on strategies and tactics pursued by us.

Director Independence

Yulong Ding, LuLu Sun and Cangsang Huang are our only non-employee directors, and our Board has determined that each of them is independent pursuant to the listing rules of NASDAQ. All of the members of each of the Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee are independent as defined in NASDAQ Rule 5605(a)(2). As required under applicable NASDAQ listing standards, in the 2015 fiscal year, our independent directors met 2 times in regularly scheduled executive sessions at which only our independent directors were present.

Board Meetings and Committee Meeting; Annual Meeting Attendance

During the year ended December 31, 2015, the Board held 8 meetings and acted through unanimous consent on 8 different occasions. In addition, the Audit Committee held 4 meetings; the Corporate Governance and Nominating Committee held 1 meeting; and the Compensation Committee held 1 meeting. During the year ended December 31, 2015, each of the directors attended, in person or by telephone, more than 75% of the meetings of the Board and the committees on which he or she served. We encourage our Board members to attend our Annual Meetings, but we do not have a formal policy requiring attendance. All of our then sitting Board members attended the 2015 Annual Meeting.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee currently consists of Yulong Ding, Cangsang Huang and LuLu Sun. Ms. LuLu Sun is the chairman of our Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee oversees all aspects of the Company’s corporate governance functions on behalf of the Board, including identifying individuals qualified to become directors, recommending to the Board the selection of director nominees for each meeting of the stockholders at which directors are elected and overseeing the monitoring and evaluation of the Company’s corporate governance practices. The Corporate Governance and Nominating Committee reviewed the performance of all of the current members of the Board and determined and recommended to the Board that all of the current directors should be nominated for re-election. No other candidates were recommended or evaluated. The Corporate Governance and Nominating Committee operates under a written charter, which is available on our website at www.creg-cn.com under the links “Investor Relations – Corporate Governance.”

Selection of Board Nominees

Our Corporate Governance and Nominating Committee is responsible for identifying, selecting and evaluating Board candidates. From a general perspective, candidates are reviewed in the context of the existing Board members, our operating requirements and the long-term interests of our stockholders. In selecting candidates for appointment or re-election to the Board, the Corporate Governance and Nominating Committee of the Board considers the following criteria: (i) personal and professional ethics and integrity, including a reputation for integrity and honesty in the business community; (ii) experience as an executive officer of companies or as a senior leader of complex organizations, including scientific, government, financial or technological organizations; (iii) financial knowledge, including an understanding of finance, accounting, the financial reporting process, and company measures for operating and strategic performance; (iv) ability to critically and independently evaluate business issues, contributing diverse perspectives or viewpoints, and making practical and mature judgments; (v) a genuine interest in the Company, and the ability to spend the time required to make substantial contributions as a director; and (vi) no conflict of interest or legal impediment that would interfere with the duty of loyalty to the Company and its stockholders. In addition, the Corporate Governance and Nominating Committee reviews the qualifications of the directors to be appointed to serve as members of the Audit Committee to ensure that they meet the financial literacy and sophistication requirements under the NASDAQ rules and that at least one of them qualifies as an “audit committee financial expert” under the rules of the SEC.

Audit Committee

The Audit Committee currently consists of Yulong Ding, Cangsang Huang and LuLu Sun, each of whom is independent under NASDAQ listing standards. Mr. Huang serves as chairman of our Audit Committee.

The Board determined that Mr. Huang qualifies as an “audit committee financial expert,” as defined by NASDAQ Rule 5605(a)(2) and Item 407 of Regulation S-K. In reaching this determination, the Board made a qualitative assessment of Mr. Huang’s level of knowledge and experience based on a number of objective and subjective factors, including formal education, financial and accounting acumen, and business experience. The Audit Committee is responsible for assisting the Board in fulfilling its oversight responsibilities with respect to: (i) the financial reports and other financial information provided by us to the public or any governmental body; (ii) our compliance with legal and regulatory requirements; (iii) our systems of internal controls regarding finance, accounting and legal compliance that have been established by management and the Board; (iv) the qualifications and independence of our independent registered public accounting firm; (v) the performance of our internal audit function and the independent registered public accounting firm; and (vi) our auditing, accounting and financial reporting processes generally. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act. In connection with its responsibilities, the Board has delegated to the Audit Committee the authority to select and hire our independent registered public accounting firm and determine their fees and retention terms. The Audit Committee’s policy is to pre-approve all audit and non-audit services by category, including audit-related services, tax services, and other permitted non-audit services. In accordance with the policy, the Audit Committee regularly reviews and receives updates on specific services provided by our independent registered public accounting firm. All services rendered by MJF and Associates, APC to the Company are permissible under applicable laws and regulations. During fiscal year 2015, all services requiring pre-approval and performed by the Company's accounting firm, MJF and Associates, APC, were approved in advance by the Audit Committee in accordance with the pre-approval policy. The Audit Committee operates under a written charter, which is available on our website at www.creg-cn.com under the links “Investor Relations – Corporate Governance.”

Compensation Committee

The Compensation Committee currently consists of Yulong Ding, LuLu Sun and Cangsang Huang. Mr. Yulong Ding is the chairman of our Compensation Committee. The Compensation Committee’s purpose is (i) to oversee the Company’s efforts to attract, retain and motivate members of the Company’s senior management team, (ii) to carry out the Board’s overall responsibility relating to the determination of compensation for all executive officers, (iii) to oversee all other aspects of the Company’s compensation policies, and (iv) to oversee the Company’s management resources, succession planning and management development activities. The Compensation Committee has the authority to engage independent advisors to assist it in carrying out its duties. During fiscal year 2015, the Compensation Committee did not engage the services of any independent advisors, experts or other third parties. We believe that the functioning of our Compensation Committee complies with any applicable requirements of NASDAQ and SEC rules and regulations. The Compensation Committee operates under a written charter, which is available on our website at www.creg-cn.com under the links “Investor Relations – Corporate Governance.”

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

All members of the Compensation Committee are independent directors. No member of our Compensation Committee is a current or former officer or employeestatus of the Company or the rights of any shareholder in any respect, or the transferability of stock certificates presently outstanding. The currently outstanding share certificates evidencing shares of the Company’s securities bearing the name China Recycling Energy Corporation will continue to be valid and represent shares of China Recycling Energy Corporation following the name change. In the future, new share certificates will be issued bearing the new name, but this in no way will affect the validity of your current share certificates.

If the proposal is approved by the shareholders, the name change will become effective upon the filing of the amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada. The Company intends to file the amendment promptly after the shareholders approve the name change. The trading symbol of the Company’s Common Stock will remain as “CREG”.

The affirmative vote of at least a majority of shares actually voted on the proposal at the Special Meeting, provided a quorum is present, is required to approve this proposed amendment to the Articles of Incorporation.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NAME CHANGE PROPOSAL

5

DELIVERY OF DOCUMENTS TO SHAREHOLDERS SHARING AN ADDRESS

Certain shareholders who share an address are being delivered only one copy of this proxy statement unless the Company or one of its subsidiaries, and no directormailing agents has received contrary instructions. Upon the written or executive officeroral request of a shareholder at a shared address to which a single copy of this proxy statement was delivered, the Company isshall promptly deliver a directorseparate copy of this proxy statement to such shareholder. Written requests should be made to China Recycling Energy Corporation, at 4/F, Tower C, Rong Cheng Yun Gu Building, Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, 710075 China, Attention: Corporate Secretary. In addition, if such shareholder wishes to receive separate annual reports, proxy statements or executive officerinformation statements in the future, such shareholder should notify the Company either in writing addressed to the foregoing address or by calling the foregoing telephone number. Shareholders sharing an address who are receiving multiple copies of any other corporation that hasthis proxy statement may request delivery of a directorsingle annual report, proxy statement or executive officer who is alsoinformation statement in the future by directing such request in writing to the address above or calling the foregoing telephone number.

ANNUAL MEETING SHAREHOLDER PROPOSALS

Shareholders wishing to submit proposals for inclusion in a directorproxy statement for a shareholder meeting subsequent to the Special Meeting should send their written proposals to China Recycling Energy Corporation, at 4/F, Tower C, Rong Cheng Yun Gu Building, Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, 710075 China, Attention: Corporate Secretary, within a reasonable time before the solicitation of proxies for such meeting. The timely submission of a proposal does not guarantee its inclusion.

OTHER SHAREHOLDER COMMUNICATIONS WITH OUR BOARD OF DIRECTORS

Our board provides a process for shareholders and interested parties to send communications to the Company.

Stockholder Communication with the Board of Directors

Stockholdersboard. Shareholders and interested parties may communicate with the Boardour board, any committee chairperson or our non-management directors as a group by writing to the attentionboard or committee chairperson in care of Mr. Jackie Shi, our Chief Financial Officer,China Recycling Energy Corporation, at 12/4/F, Tower A, Chang An InternationalC, Rong Cheng Yun Gu Building, No. 88 Nan Guan Zheng Jie,Keji 3rd Road, Yanta District, Xi’an City, Shaanxi Province, 710068 China.

Code of Ethics

We have adopted a “code of ethics” as defined by regulations promulgated under710075 China, Attention: Corporate Secretary. Each communication will be forwarded, depending on the Securities Act of 1933, as amended, and the Exchange Act that applies to all of our directors and employees worldwide, including our principal executive officer, principal financial officer and principal accounting officer. A current copy of our Code of Business Conduct and Ethics is available on our website at www.creg-cn.com under the links “Investor Relations – Corporate Governance.” We intend to disclose any amendmentssubject matter, to the Code of Business Conduct and Ethics, as well as any waivers for executive officersboard, the appropriate committee chairperson or directors, on our website.

all non-management directors.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

PRINCIPAL SHAREHOLDERS

The following table sets forth certain information provided to us by each of the following as of April 27, 2016the date hereof (unless otherwise indicated) regarding their beneficial ownership of our common stock:

| • each person, entity or group (as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934) known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock; |

Beneficial• each of our directors and named executive officers; and

• all of our directors and named executive officers as a group.

Information relating to beneficial ownership of common stock by our principal stockholders and management is determined in accordance withbased upon information furnished by each person using “beneficial ownership” concepts under the rules of the SEC and includes voting and investment power with respect to the securities. Except as indicated by footnote, and subject to applicable community property laws, the persons and entities named in the table below have sole voting and sole investment power with respect to the shares set forth opposite each person’s or entity’s name.

| Common Stock | ||||||||

| Beneficially Owned | ||||||||

| Beneficial Owner | Number of Shares | Percent of Class | ||||||

| Pucheng Xin Heng Yuan Biomass Power Generation Corporation | 8,766,547 | (1) | 10.55 | % | ||||

| No 505, Block A, Bei Shao Men, Shi Ji Jin Yuan Residential Quarter, No. 14 Wei Yang Road | ||||||||

| Xi'an City, Shannxi Province, China 71004 | ||||||||

| Carlyle Asia Growth Partners III, L.P. | 5,506,420 | (2) | 6.63 | % | ||||

| c/o The Carlyle Group | ||||||||

| 1001 Pennsylvania Avenue, NW, Suite 220 South | ||||||||

| Washington, DC 20004-2505 | ||||||||

| Superb Growth Holding Limited | 8,033,779 | (3) | 9.67 | % | ||||

| Room 1301, #5-3, Zuo An Pu Yuan, Zuo An Men Nei Street | ||||||||

| Chong Wen District, Beijing | ||||||||

| Guohua Ku | 31,879,074 | (4) | 38.37 | % | ||||

| Bohan Zhang | 1,700 | * | ||||||

| Jackie Shi | — | — | ||||||

| Xiaoshan He | 93,543 | * | ||||||

| Geyun Wang | 100,578 | * | ||||||

| Cangsang Huang | 40,000 | (5) | * | |||||

| Yulong Ding | — | — | ||||||

| LuLu Sun | ||||||||

| David Chong | 200,000 | (6) | — | |||||

| All executive officers and directors as a group (9 persons) | 32,114,895 | (7) | 38.65 | % | ||||

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes the compensation earned during the years ended December 31, 2015 and 2014, by those individuals who served as our Chief Executive Officer, or Chief Financial Officer during any part of fiscal year 2015 or any other executive officer with total compensation in excess of $100,000 during fiscal year 2015. The individuals listed in the table below are referred to as the “named executive officers.”

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||

| Guohua Ku (1) | 2015 | 17,876 | -- | -- | Nil | -- | -- | -- | 17,876 | |||||||||||||||||||||||||

| Chief Executive Officer | ||||||||||||||||||||||||||||||||||

| and Chairman of the Board | 2014 | 17,876 | -- | -- | Nil | -- | -- | -- | $ | 17,876 | ||||||||||||||||||||||||

| Jackie Shi (2) | 2015 | 19,723 | -- | -- | Nil | -- | -- | -- | 19,723 | |||||||||||||||||||||||||

| Chief Financial | ||||||||||||||||||||||||||||||||||

| Officer and Secretary | 2014 | N/A | -- | -- | Nil | -- | -- | -- | $ | N/A | ||||||||||||||||||||||||

| David Chong (3) | 2015 | 9,245 | Nil | 9,245 | ||||||||||||||||||||||||||||||

| Chief Financial Officer and | ||||||||||||||||||||||||||||||||||

| Secretary | 2014 | 90,900 | Nil | 90,900 | ||||||||||||||||||||||||||||||

Narrative to Summary Compensation Table

In fiscal year 2015, the primary components of our executive compensation programs were base salary and equity compensation. We use base salary to fairly and competitively compensate our executives, including the named executive officers, for the jobs we ask them to perform. We view base salary as the most stable component of our executive compensation program, as this amount is not at risk. We believe that the base salaries of our executives should be targeted at or above the median of base salaries for executives in similar positions with similar responsibilities at comparable companies, consistent with our compensation philosophy. Because of our emphasis on performance-based compensation for executives, base salary adjustments are generally made only when we believe there isSEC. Under these rules, a significant deviation from the market or an increase in responsibility. Our Compensation Committee reviews the base salary levels of our executives each year to determine whether an adjustment is warranted or necessary.

Employment Contracts

Mr. Guohua Ku entered into an employment agreement with the Company to serve as its CEO on December 10, 2008. The agreement had a two-year term, starting December 10, 2008, that included a one-month probationary period. In accordance with the terms and conditions of Mr. Ku’s employment agreement, on December 10, 2010, and, more recently, on December 10, 2014, the Company and Mr. Ku agreed to renew Mr. Ku’s employment agreement for an additional two-year term. Mr. Ku receives a salary of $17,876 annually for his service as CEO. The Company may terminate the employment agreement at any time without any prior notice to the employee if Mr. Ku engages in certain conduct, including, but not limited to (i) the violation of the rules and procedures of the Company or breaches the terms of the employment agreement; (ii) neglecting his duties or engages in malpractice for personal gain that damages the Company; (iii) entering into an employment relationship with any other employer during his employment with the Company; or (iv) the commission of a crime. The Company also may terminate the employment agreement upon 30 days written notice to Mr. Ku under certain other conditions, including but not limited to (i) inability to continue position due to non-work-related sickness or injury; (ii) incompetence; and (iii) the need for mass layoffs or other restructuring. Mr. Ku has the right to resign at any time upon a 30 days written notice to the Company.

In connection with his appointment as Chief Financial Officer and Secretary, the Company entered into an employment agreement with Mr. Shi on May 7th, 2015. The employment agreement provides that Mr. Shi will receive compensation in the amount of RMB 16,000 (approximately $2,581) per month plus stock options for no less than 200,000 shares of common stock of the Company each year to be issued under the China Recycling Energy Corporation Omnibus Equity Plan (the “Plan”) with the detailed terms of the options to be determined by the Compensation Committee of the Board and the Board of Directors of the Company in the future when and upon the approval of the Plan by the stockholders of the Company at its annual meeting on June 19, 2015. The term of the employment agreement is for two years, starting on May 16th, 2015. The shareholders approved China Recycling Energy Corporation Omnibus Equity Plan at the annual meeting on June 19, 2015 and the Compensation Committee has not granted any stock options to Mr. Shi as of April 27, 2016.

Nonstatutory Stock Option Plan – Equity Compensation

In August, 2008 and November, 2009, the Company granted certain employees stock options under the Company’s 2007 Non-Statutory Stock Option Plan, which was later amended and restated in 2010, to acquire 3,000,000 shares of the Company’s common stock. The options had a life of five years and the options granted in 2008 and 2009 expired in 2013 and 2014. On August 13, 2010, the Company granted 2,200,000 options to acquire the Company’s common stock at $3.05 per share to 36 managerial and non-managerial employees as new equity awards pursuant to the Company's Amended and Restated 2007 plan. According to the vesting terms, the options granted were divided into three tranches, (i) 1/3 (one third) of the total number of shares subject to the options were to vest and become exercisable if the Company met its minimum revenue and earnings goals in the Company’s guidance for 2010 as delivered in its earnings releases and/or conference calls in the first quarter of 2010, such vesting to occur immediately upon completion of the annual audit confirming the financial results for 2010; and (ii) an additional 1/3 (one third) of the total number of shares subject to the options were to vest and become exercisable if the Company met certain financial goals of 2011 as set out and decided by the Compensation Committee, such vesting to occur immediately upon the Compensation Committee’s determination that the Company had met such goals for 2011; and (iii) the remaining 1/3 (one third) of the total number of shares subject to the options were to vest and become exercisable if the Company met certain financial goals of 2012 as set out and decided by the Compensation Committee, such vesting to occur immediately upon the Compensation Committee’s determination that the Company had met such goals for 2012. The options could only be exercised to the extent that such options became vested and exercisable. The Company did not meet the financial goals of 2012 and 2011; accordingly, the second and third tranches (two-thirds of the total number of 2,200,000 options) were forfeited.

The vesting terms of options granted under the 2007 Plan are subject to certain nonstatutory stock option agreements. The exercise price of each option granted under the 2007 Plan is at least 100% of the fair market value of a share of our common stock on the date of grant. For purposes of option awards, fair market value of a share of our common stock means the closing sale price of a share of our common stock on the relevant date on the principal exchange on which the common stock is then listed or admitted to trading. If no reported sale of common stock takes place on the relevant date on the principal exchange, then the reported closing asked price of a share of our common stock on such date on the principal exchange shall be the fair market value. If our common stock is not at the time listed or admitted to trading on a stock exchange, the fair market value of a share of our common stock means between the lowest reported bid price and highest reported asked price of a share of our common stock on the relevant date in the over-the-counter market, as such prices are reported in a publication of general circulation selected by the Board or the Compensation Committee and regularly reporting the market price of a share of our common stock. If our common stock is not listed or admitted to trading on any stock exchange or traded in the over-the-counter market, the Board shall determine the fair market value in good faith.

The Company’s 2007 Non-Statutory Stock Option Plan expired in November, 2012.

In June of 2015, the stockholders of the Company approved the China Recycling Energy Corporation Omnibus Equity Plan (the “2015 Equity Plan”) at its annual meeting. The total aggregate shares of common stock authorized for issuance during the term of the 2015 Equity Plan is 12,462,605 shares. The 2015 Equity Plan will terminate on the earliest to occur of (i) the 10th anniversary of the Equity Plan's effective date, or (ii) the date on which all shares available for issuance under the Equity Plan shall have been issued as fully-vested shares.

Potential Payments Upon Termination or Change of Control

Employment Agreements

Certain of our executive officers, including our CEO, have an employment agreement with the Company. Under Chinese law, we may only terminate employment agreements without cause and without penalty by providing notice of non-renewal one month prior to the date on which the employment agreement is scheduled to expire. If we fail to provide this notice or if we wish to terminate an employment agreement in the absence of cause, as defined in the agreement, then we are obligated to pay the employee one month’s salary for each year we have employed the employee. We are, however, permitted to terminate an employee for cause without penalty pursuant to the employment agreement.

2007 Plan

On August 13, 2010, the Company granted 2,200,000 options to acquire the Company’s common stock at $3.05 per share to 36 managerial and non-managerial employees as new equity awards pursuant to the Corporation’s Amended and Restated 2007 plan. According to the vesting terms, the options granted were divided into three tranches, (i) 1/3 (one third) of the total number of shares subject to the options shall vest and become exercisable if the Company meets its minimum revenue and earnings goals in the Company’s guidance for 2010 as delivered in its earnings releases and/or conference calls in the first quarter of 2010, such vesting to occur immediately upon completion of the annual audit confirming the financial results for 2010; and (ii) an additional 1/3 (one third) of the total number of shares subject to the options shall vest and become exercisable if the Company meets certain financial goals of 2011 which will be set out and decided by the Compensation Committee, such vesting to occur immediately upon Compensation Committee’s determination that the Company has met such goals for 2011; and (iii) the remaining 1/3 (one third) of the total number of shares subject to the options shall vest and become exercisable if the Company meets certain financial goals of 2012 which is set out and decided by the Compensation Committee, such vesting is to occur immediately upon Compensation Committee’s determination that the Company has met such goals for 2012. The options may only be exercised to the extent that such options have become vested and exercisable.

As of December 31, 2012 and 2011, the Company did not meet the financial goals of 2012 and 2011; accordingly, the second and third tranche (two thirds of the total number of 2,200,000 options) was forfeited.

The options have a life of five years. The FV of the options was calculated using the following assumptions; estimated life of five years, volatility of 92%, risk free interest rate of 3.54%, and dividend yield of 0%. Each tranche of the optionsperson is deemed to be independenta beneficial owner of a security if that person directly or indirectly has or shares voting power, which includes the power to vote or direct the voting of the others. Therefore,security, or investment power, which includes the FVpower to dispose or direct the disposition of the first tranche of options was expensed during 2011; the second and third tranche of options were forfeited due to the non-achievement of established financial benchmarks.security. The options granted pursuant to the 2007 Plan expired in August 2015 and all such options have been cancelled.

2015 Plan

In June of 2015, the stockholders of the Company approved the China Recycling Energy Corporation Omnibus Equity Plan (the “2015 Equity Plan”) at its annual meeting. The total aggregate shares of common stock authorized for issuance during the term of the 2015 Equity Planperson is 12,462,605 shares. The 2015 Equity Plan will terminate on the earliest to occur of (i) the 10th anniversary of the Equity Plan's effective date, or (ii) the date on which all shares available for issuance under the Equity Plan shall have been issued as fully-vested shares. No share or option has been granted to any executive officers under the 2015 Equity Plan as of December 31, 2015

NON-EMPLOYEE DIRECTOR COMPENSATION

Non-Employee Director Compensation

The following table sets forth certain information regarding the compensation earned by or awarded during the 2015 fiscal year to each of our non-executive directors:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) (1)(2) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

| Cangsang Huang(3) | 18,000 | -- | 9,390 | -- | -- | -- | 27,390 | |||||||||||||||||||||

| Yulong Ding | 24,000 | -- | -- | -- | -- | 24,000 | ||||||||||||||||||||||

| LuLu Sun(3) | 10,000 | -- | -- | -- | -- | 10,000 | ||||||||||||||||||||||

|

|

| ||||

EQUITY COMPENSATION PLAN INFORMATION

The table below sets forth information with respect to shares of our common stock that may be issued under the 2015 Plan, as of December 31, 2015:

| Plan Category | Number of to be issued exercise of outstanding | Weighted-average exercise price of outstanding options | Number of securities remaining for future under equity compensation | ||||||||

| Equity compensation plans approved by security holders | 40,000 | $ | 12,422,605 | ||||||||

| Equity compensation plans not approved by security holders | -- | -- | -- | ||||||||

| Total | 40,000 | $ | 12,422,605 | ||||||||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has not implemented a written policy concerning the review of related party transactions; however, the Company’s policy is that the Audit Committee must review related party transactions and Board must approve all related party transactions. Further, all material related party transactions will be made or entered into on terms that are no less favorable to us than can be obtained from unaffiliated third parties.

A “related party transaction” is a transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) or any series of similar transactions, arrangements or relationships in which the Company (including any of our subsidiaries) was, is or will be a participant, the amount involved exceeds $120,000, and in which any related person had, has or will have a direct or indirect interest.

For fiscal year ended December 31, 2015, the Company was involved in the following related party transactions:

During the year ended December 31, 2015, the Company received RMB 30.47 million ($4.89 million) in interest income for the sales-type lease of the Pucheng BMPG systems from Pucheng Xin Heng Yuan Biomass Power Generation Corporation, whose major shareholder became a shareholder of CREG through the issuance of the Company’s common stock to this shareholder in exchange for transferring a coal power generation system to CREG for transformation to a biomass power generation system.

During the year ended December 31, 2015, the Company received RMB 33.34 million ($5.35 million) in interest income for the sales-type lease of the Yida WGPG system from Qitaihe City Boli Yida Coal Selection Co., Ltd., whose major shareholder became a shareholder of CREG through the issuance of the Company’s common stock to this shareholder for transferring the old system to CREG for WGPG system transformation.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has furnished the following report on its activities during the fiscal year ended December 31, 2015. The report is notalso deemed to be “soliciting material” or “filed” witha beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the SEC or subject to the SEC’s proxy rules, or to the liabilities of Section 18 of the Exchange Act, and the report shall notmore than one person may be deemed to be incorporated by reference into any prior or subsequent filing under the Securities Act or the Exchange Act except to the extent that the Company specifically incorporates it by reference into any such filing.

The primary functiona beneficial owner of the Audit Committee issame securities, and a person may be deemed to assist the Board in its oversight and monitoringbe a beneficial owner of our financial reporting and auditing process. The Audit Committee charter sets forth the responsibilities of the Audit Committee. A copy of the Audit Committee charter is available on our website at www.creg-cn.com under the links “Investor Relations – Corporate Governance.” For fiscal year 2015, the Audit Committee was comprised of Cangsang Huang (Chairman), Lulu Sun, and Yulong Ding, each of whom is independent under applicable SEC and NASDAQ listing standards.